kansas sales tax exemption form pdf

Get everything done in minutes. Movement in interstate commerce.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

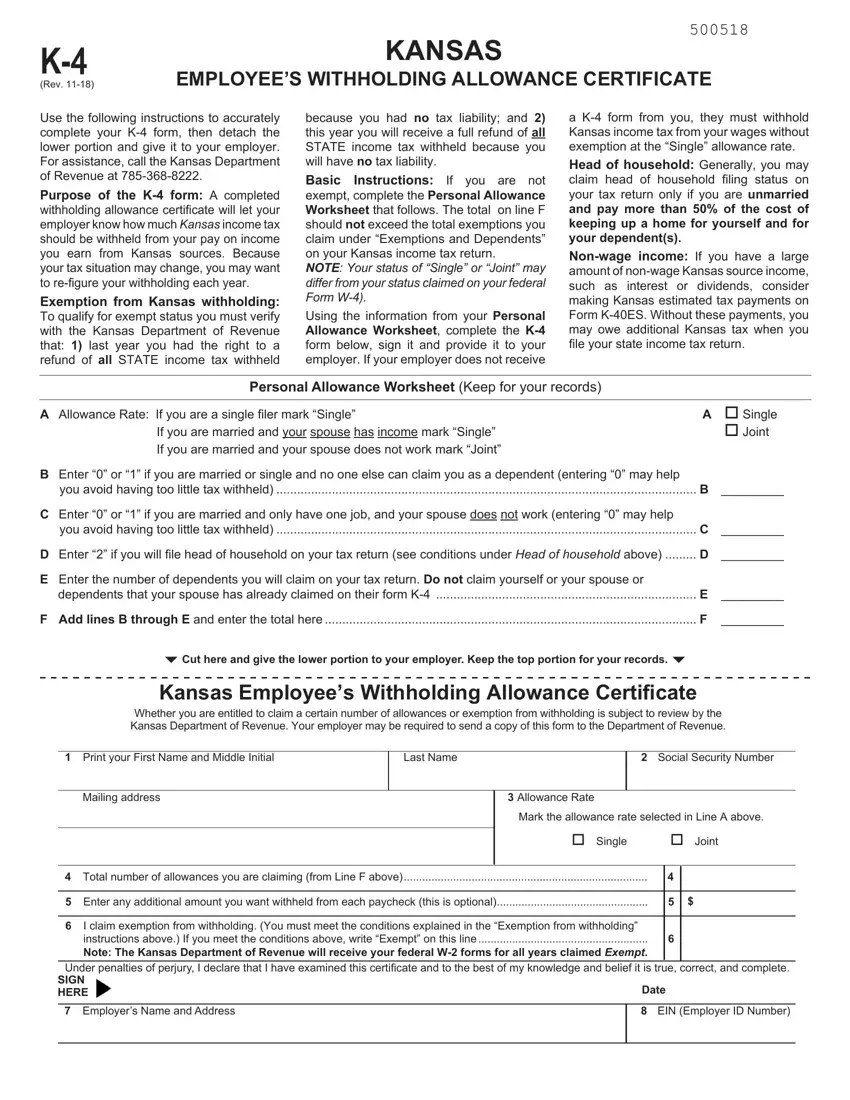

As a registered retailer or consumer you will receive updates from the Kansas Department of.

. Kansas Sales Tax Registration Number andor Employer ID Number EIN Type of business 5. STATEMENT FOR SALES TAX EXEMPTION ON ELECTRICITY GAS OR WATER FURNISHED THROUGH ONE METER. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor.

ST-28B Sales Tax Exemption on Electricty Gas or Water Rev. Barbed wire T-posts concrete mix post caps T-post clips screw hooks nails staples gates electric fence posts electric insulators and electric fence chargers. Use Fill to complete blank online KANSAS DEPARTMENT OF COMMERCE KS pdf forms for free.

If any of these links are broken or you cant find the form you need please let us know. For corporations whose business income is solely within state boundaries the tax is 4 of net income. Revenues basic sales tax publication KS-1510 Kansas Sales and Compensating Use Tax.

ST-28B Sales Tax Exemption on Electricty Gas or Water Rev. This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. All forms are printable and.

_____ Applicant Name Owner of Record. Describe the taxable service. Kansas Department of Revenue Home Page.

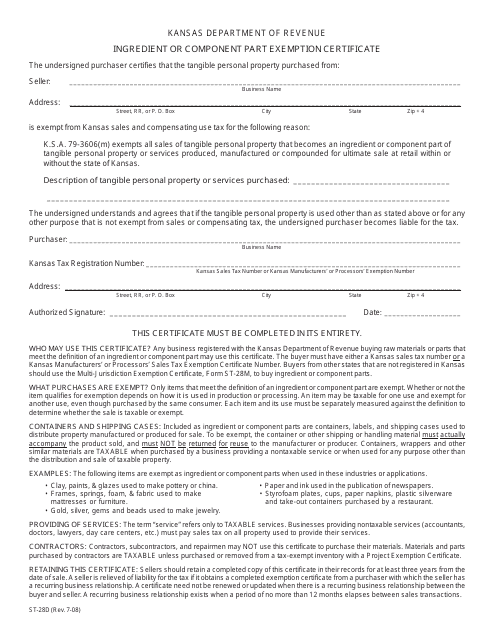

Please complete one of the. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. Kansas Tax Exempt Form PDF.

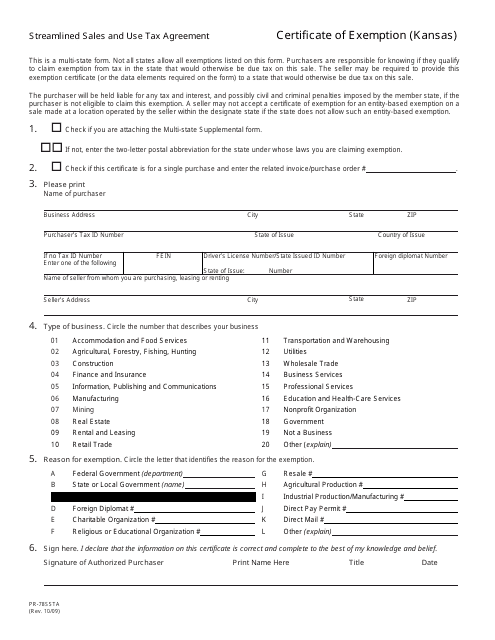

The seller may require a copy of the buyers Kansas sales tax registration. We have four Kansas sales tax exemption forms available for you to print or save as a PDF file. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax.

BEFORE THE BOARD OF TAX APPEALS OF THE STATE OF KANSAS TAX EXEMPTION KSA. If you have questions about this form contact our Utility Refund. Once completed you can sign your fillable form or send for signing.

In addition net income in excess of 50000 is subject to a 3. And provide their Kansas sales tax number on this form may use this certificate to purchase inventory without tax. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates.

Business Form Finder All Forms On File For Department Of Revenue

St28a Form Fill Out Sign Online Dochub

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Kansas City Business Tax Registration

Kansas Quitclaim Deed Form Legal Templates

Free 10 Sample Tax Exemption Forms In Pdf

Fill Free Fillable Kansas Department Of Revenue Pdf Forms

Kansas Affidavit Exempt Workers Fill Online Printable Fillable Blank Pdffiller

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Kansas Tax Exempt Certificate Fill Out Sign Online Dochub

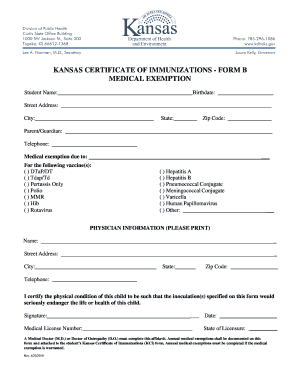

Free Vaccine Exemption Form Free To Print Save Download

Kansas Form Medical Fill Out And Sign Printable Pdf Template Signnow

Form Pr 78ssta Download Fillable Pdf Or Fill Online Streamlined Sales And Use Tax Agreement Certificate Of Exemption Kansas Kansas Templateroller

Kansas Form K 4 Fill Out Printable Pdf Forms Online

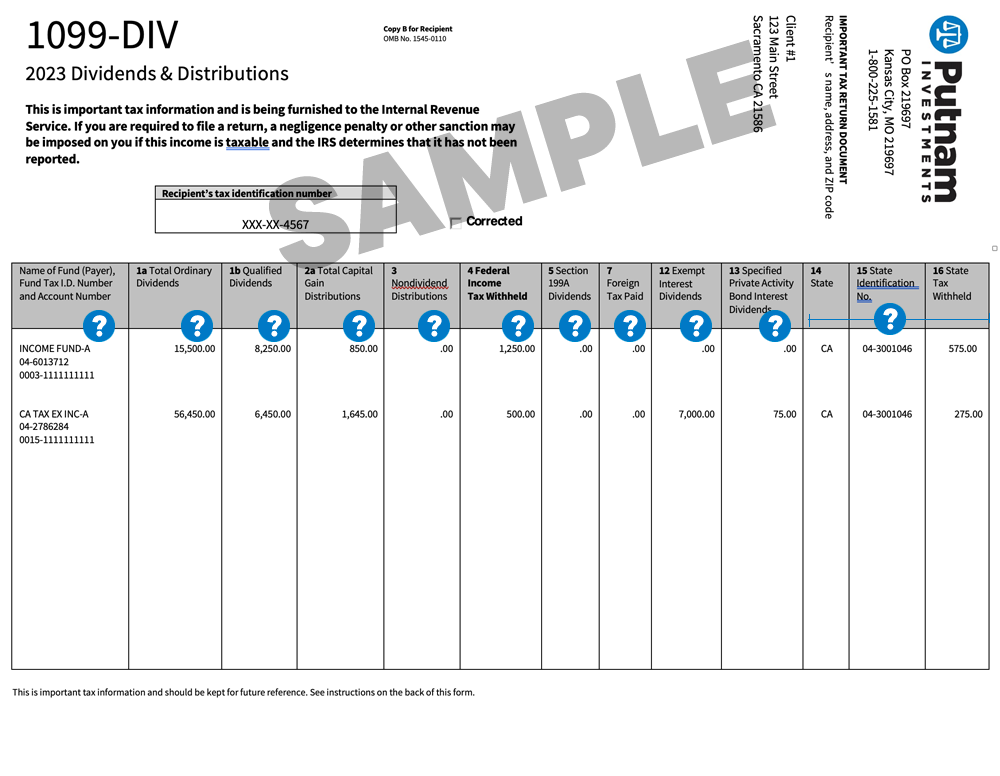

Help With Forms Putnam Investments

4 State Back To School Bashes And Sales Tax Holidays Koam

Kansas Tax Exempt Not For Profit Organizations Attorneys Law Firm

Get And Sign Who Fills Out Kansas Department Of Revenue For Pr 74a Form 2005 2022